AUD/USD

Select Currency

Technical Analysis

...

...

...

1 Month Time Interval

Sell Zone : 0.66600-0.67200

Invalidation : 0.69100

1 Week Time Interval

1st Zone : 0.65130-0.64500

2nd Zone : 0.63770-0.63380

Invalidation : 0.62700

1 Day Time Interval

Sell Zone : 0.66050-0.66750

Invalidation : 0.66900

4 Hours Time Interval

1st Zone : 0.66020-0.66135

2nd Zone : 0.66390-0.66760

Invalidation : 0.66900

30 Minutes Time Interval

1st Zone : 0.65530-0.65450

2nd Zone : 0.65310-0.65280

Invalidation : 0.65250

Fundamental Analysis

The Australian dollar depreciated past $0.64 and was on track to lose more than 2% this week, as the Reserve Bank of Australia delivered what analysts considered as a dovish interest rate hike.

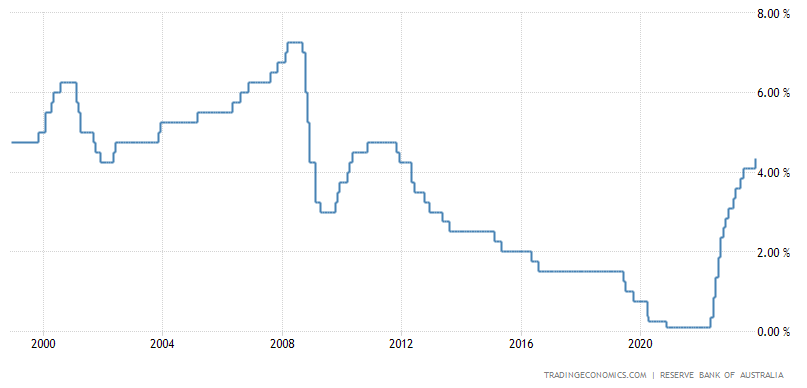

The central bank raised its cash rate by 25 basis points to 4.35% during its November meeting in a widely expected move, as inflation proved more persistent than anticipated a few months ago.

However, the RBA replaced a previous statement that “some” further tightening may be needed with “whether” a move would be necessary depending on incoming data.

Tuesday's move brought borrowing costs to their highest level since January 2011, marking the 13th rate rise since May 2022, as inflation proved more persistent than expected a few months ago due to a further rise in prices of services. CPI inflation is now projected to be around 3-1/2% by the end of 2024 and at the top of the target range of 2 to 3% by the end of 2025. New governor Michelle Bullock said in a statement that whether further tightening is needed to bring inflation returns to the target in a reasonable timeframe will depend upon the data and the evolving assessment of risks. The board reiterated that it will closely monitor the global economy, trends in domestic demand, and the outlook for inflation and the labor market. The board also hiked the interest rate on Exchange Settlement balances at 4.25%.

Australia's inflation rate fell to 5.4% year-on-year in the third quarter of 2023, down from 6.0% in the previous period and compared to market forecasts of 5.3%. This marked the third quarter in a row of lower annual inflation, pointing to the softest figure since the first quarter of 2022, driven by a slowdown in goods and services inflation. Goods inflation eased to a near two-year low of 4.9% from 5.8% in Q2, underpinned by a slowdown in food inflation (4.8% vs 7.5%), furniture, and housing. Services inflation slowed to 5.8% from 6.3%, the lowest since the third quarter of 2022, amid softer rises in prices of hairdressers services (6.7% vs 7.1%), financial services (6.9% vs 7.1%), restaurant meals (6.1% vs 6.5%), and holiday travel (6.8% vs 12.2%). Meanwhile, the RBA's Trimmed Mean CPI climbed by 5.2% year-on-year, marking the slowest growth rate in over a year, but still remaining well above the central bank's target range of 2-3%.

The dollar index weakened to around 103.6 on Monday, hovering at its lowest levels in 11 weeks as recent data reinforced bets that the Federal Reserve has reached the end of its tightening cycle. The central bank is widely expected to keep rates unchanged again in December, while markets see a 30% chance that the Fed could begin lowering rates as early as March 2024. Inventors now await the latest FOMC minutes and a slew of economic data in the US for further guidance. Meanwhile, China’s central bank left its one and five-year loan prime rates steady at 3.45% and 4.2%, respectively, in line with expectations. The dollar weakened across the board, with the most pronounced selling activity versus the antipodean currencies and the yuan.

The Federal Reserve kept the target range for the federal funds rate at its 22-year high of 5.25%-5.5% for a second consecutive time in November, reflecting policymakers' dual focus on returning inflation to the 2% target while avoiding excessive monetary tightening. Policymakers emphasized that the extent of any additional policy tightening would consider the cumulative impact of previous interest rate hikes, the time lags associated with how monetary policy influences economic activity and inflation, and developments in both the economy and financial markets. During the press conference, Powell signaled that the September dot-plot showing the majority of participants forecasting one more rate hike this year may not be accurate anymore. He also stated the FOMC had not discussed any rate cuts yet, while the primary focus remains on whether the central bank will need to implement additional rate hikes.

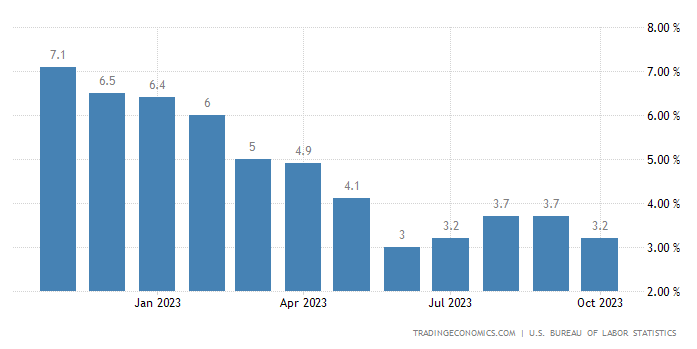

The annual inflation rate in the US slowed to 3.2% in October 2023 from 3.7% in both September and August, and below market forecasts of 3.3%. Energy costs dropped 4.5% (vs -0.5% in September), with gasoline declining 5.3%, utility (piped) gas service falling 15.8% and fuel oil sinking 21.4%. Additionally, prices increased at softer pace for food (3.3% vs. 3.7%), shelter (6.7% vs. 7.2%) and new vehicles (1.9% vs. 2.5%) and continued to decline for used cars and trucks (-7.1%). On the other hand, prices rose faster for apparel (2.6% vs. 2.3%), medical care commodities (4.7% vs. 4.2%), and transportation services (9.2% vs. 9.1%). Compared to September, the CPI was unchanged, the least in fifteen months, and below forecasts of a 0.1% rise, as lower gasoline prices (-5%) offset increases in prices for shelter (0.3%), natural gas (1.2%) and food (0.3%). Meanwhile, the core CPI unexpectedly rose 4% on the year and 0.2% on the month, below forecasts of 4.1% and 0.3% respectively.