Types of forex orders

There are some basic order types that all brokers provide and some others sound strange.

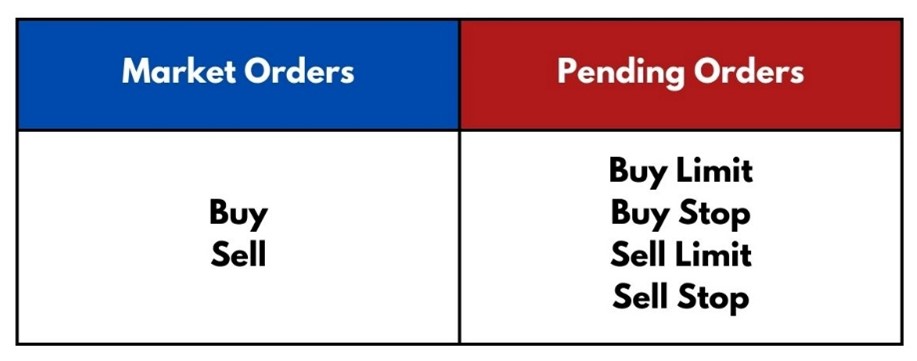

There are 2 types of orders:

- Market orders: orders that are executed immediately against a price that has been prepared by your broker.

- Pending orders: orders that will be executed later at the price you specify.

Market Orders

A market order is an order to buy or sell at the current market price.

Pending Orders

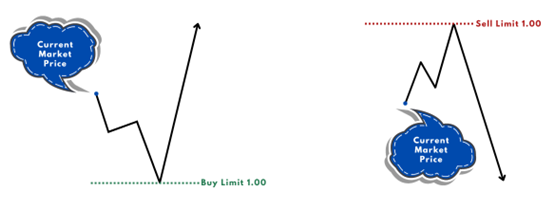

- Limit Orders

A limit order is an order placed to either buy below the market or sell above the market at a certain price. This is an order to buy or sell once the market reaches the "limit price". You place a "Buy Limit" order to buy at or below a specified price. You place a "Sell Limit" order to sell at a specified price or better. Once the market reaches the "limit price" the order is triggered and executed at the "limit price" (or better).

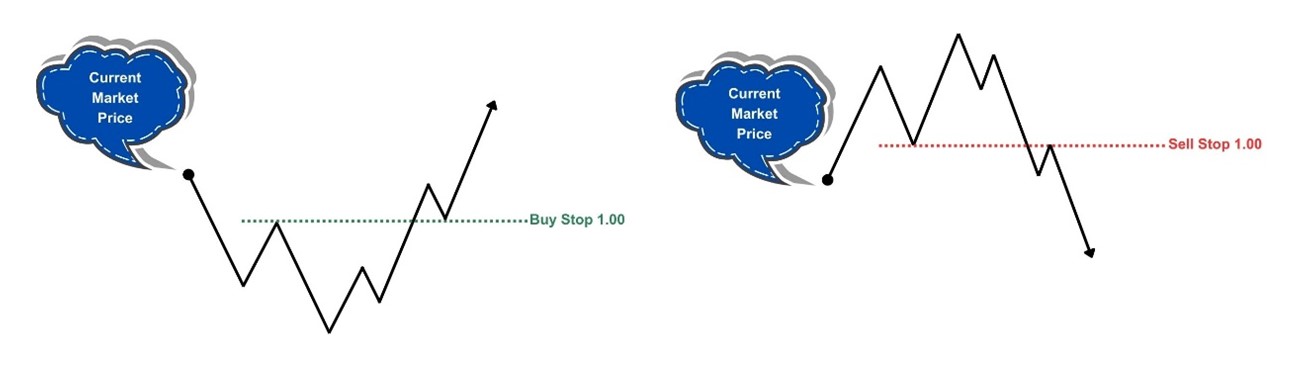

- Stop Orders

A stop order "stops" an order from executing until the price reaches the stop price. A stop-entry order is an order placed to buy above the market or sell below the market at a specific price. For example, you place a "Buy Stop" order to buy at a price above the market price, and it will be triggered when the market price touches or passes through the Buy Stop price. Same as "Sell Stop", we can sell at a price level above and below the current price.

Next Topic: Advanced Education